johnson county kansas vehicle sales tax calculator

You may write one check to pay for multiple vehicles. For instance if you purchase a vehicle from a private party for 27000 and you live in a county.

Wake County Nc Property Tax Calculator Smartasset

Kansas State Sales Tax.

. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 928 in Johnson County Kansas. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. Average Local State Sales Tax.

Mail checks to Johnson County Treasurer at the Motor Vehicle Mailing Address. The current total local sales tax rate in Johnson County KS is 7975. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 928 in Johnson County Kansas.

Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. The sales tax rate for Shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the Shawnee Kansas Sales Tax Comparison Calculator. Maximum Possible Sales Tax.

The johnson kansas general sales tax rate is 65the sales tax rate is always 75 every 2021 combined rates mentioned above are the results of kansas state rate 65 the county. This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Johnson County Kansas is.

The median property tax on a. Kansas has a 65 sales tax and Johnson County collects an additional. The median property tax on a 20990000 house is 266573 in Johnson County.

Please include the vehicle s plate number on the. The Kansas state sales tax rate is currently. Your vehicle renewals will cost.

The median property tax on a 20990000 house is 270771 in Kansas. The following page will only calculate personal property taxes. The johnson kansas general sales tax rate is 65the sales tax rate is always 75 every 2021 combined rates mentioned above are the results of kansas state rate 65 the county rate.

The figure shown does NOT include registration fees title fees or sales tax if you purchased this vehicle out of state. The rate ranges from 75 and 106. Maximum Local Sales Tax.

The Johnson County Kansas sales tax is 798 consisting of 650 Kansas state sales tax and 148 Johnson County local sales taxesThe local sales tax consists of a 148 county sales. Marion County Treasurers office is now offering a new service that you can use to estimate the cost of. US Sales Tax Rates KS Rates Sales Tax Calculator.

Choose a search method VIN 10 character. Sales Tax Table For Johnson County Kansas. The state sales tax applies for private car sales in Kansas.

The johnson kansas general sales tax rate is 65the sales tax rate is always 75 every 2021 combined rates mentioned above are the results of kansas state rate 65 the county. This page covers the most important aspects of Kansas sales tax with respects to vehicle purchases. The sales tax rate for Shawnee was.

The latest sales tax rate for Jackson County KS. The average cumulative sales tax rate in Johnson Kansas is 75. Schools Special Hunting Opportunities.

For vehicles that are being rented or leased see see taxation of leases and rentals. Johnson is located within Stanton County Kansas. This includes the rates on the state county city and special levels.

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. The Johnson County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Johnson County Kansas in the USA using average Sales Tax Rates.

The total sales tax rate in any given location can be broken down into state county city and special district rates.

Sales Tax On Cars And Vehicles In Kansas

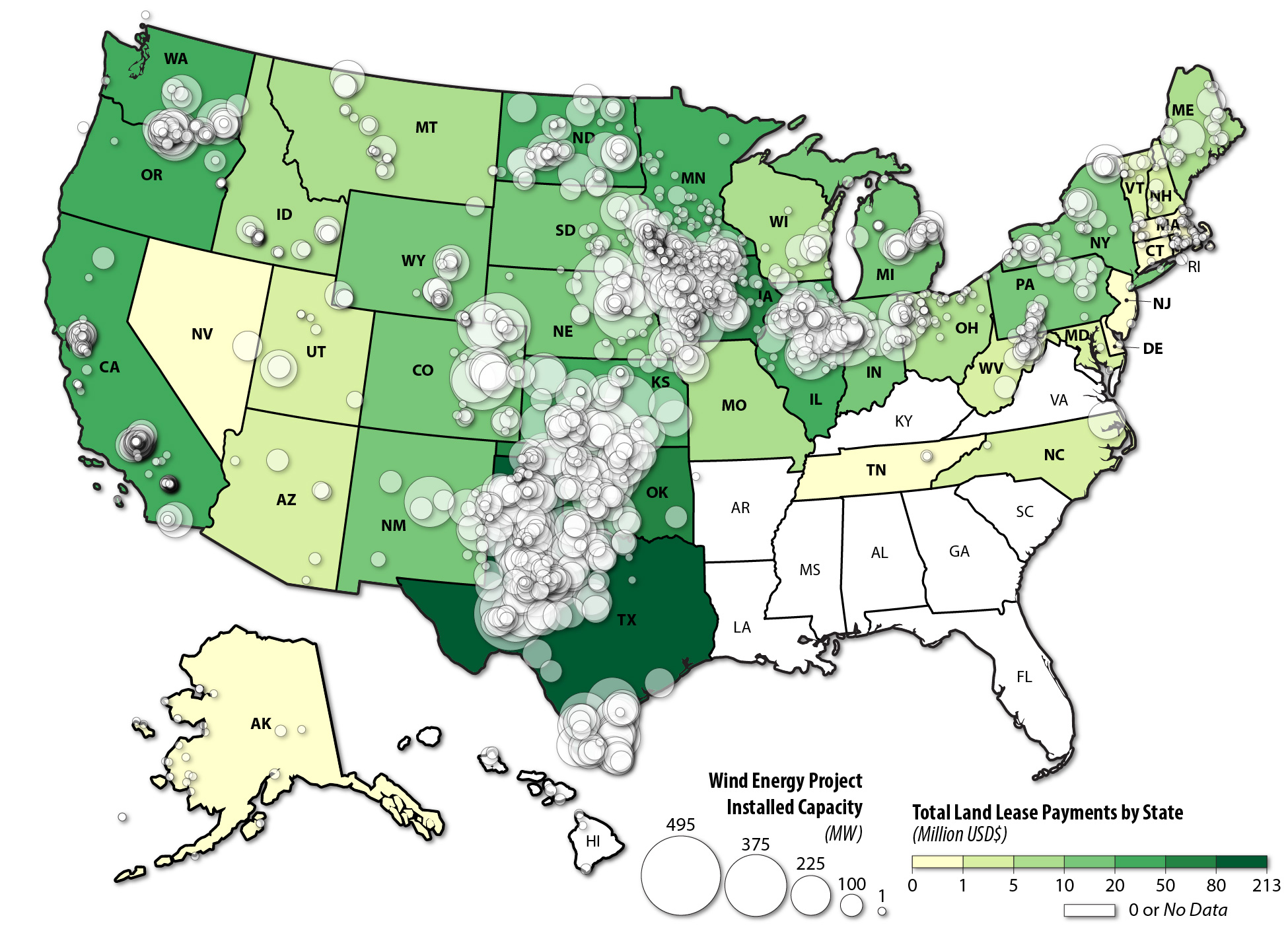

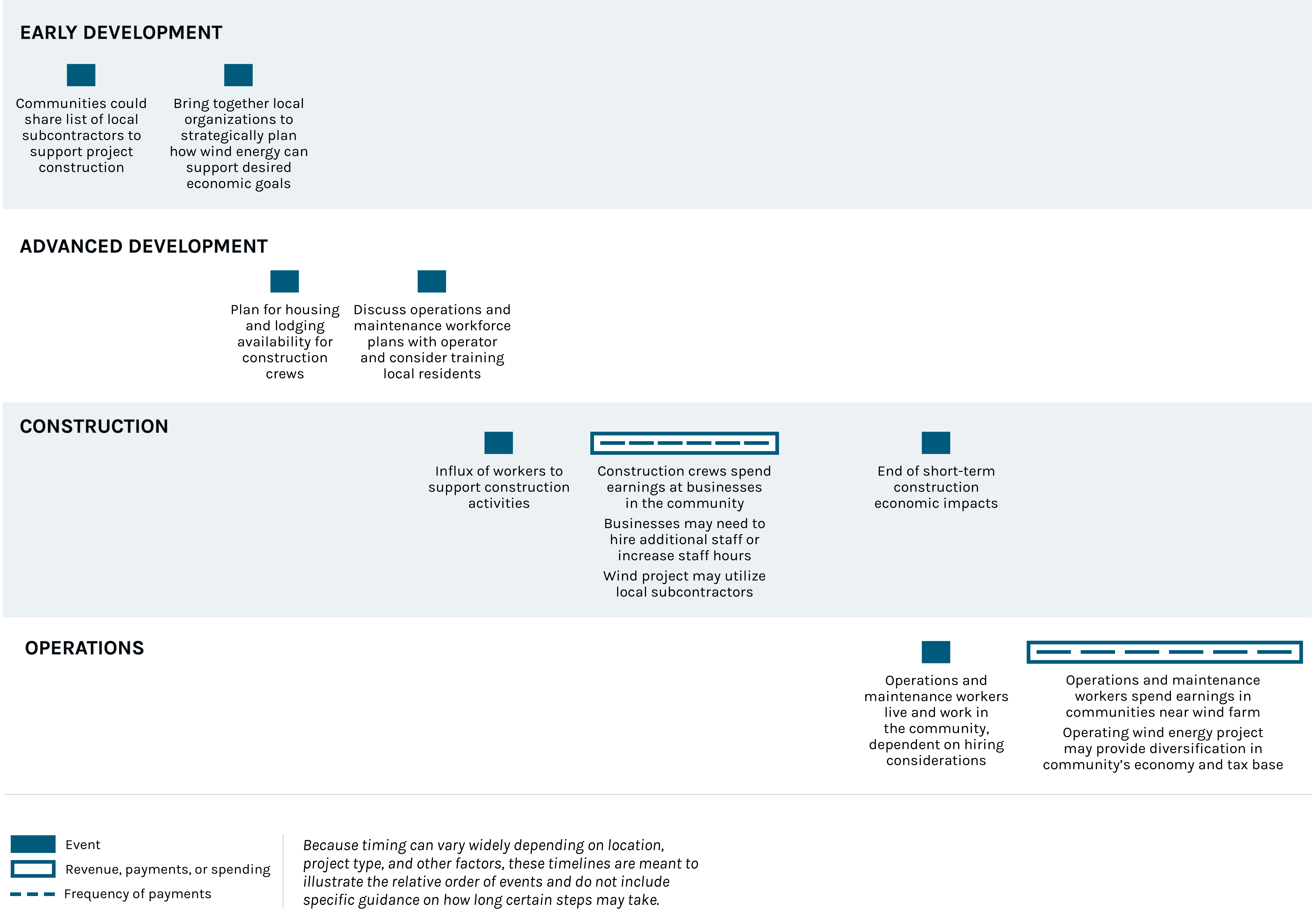

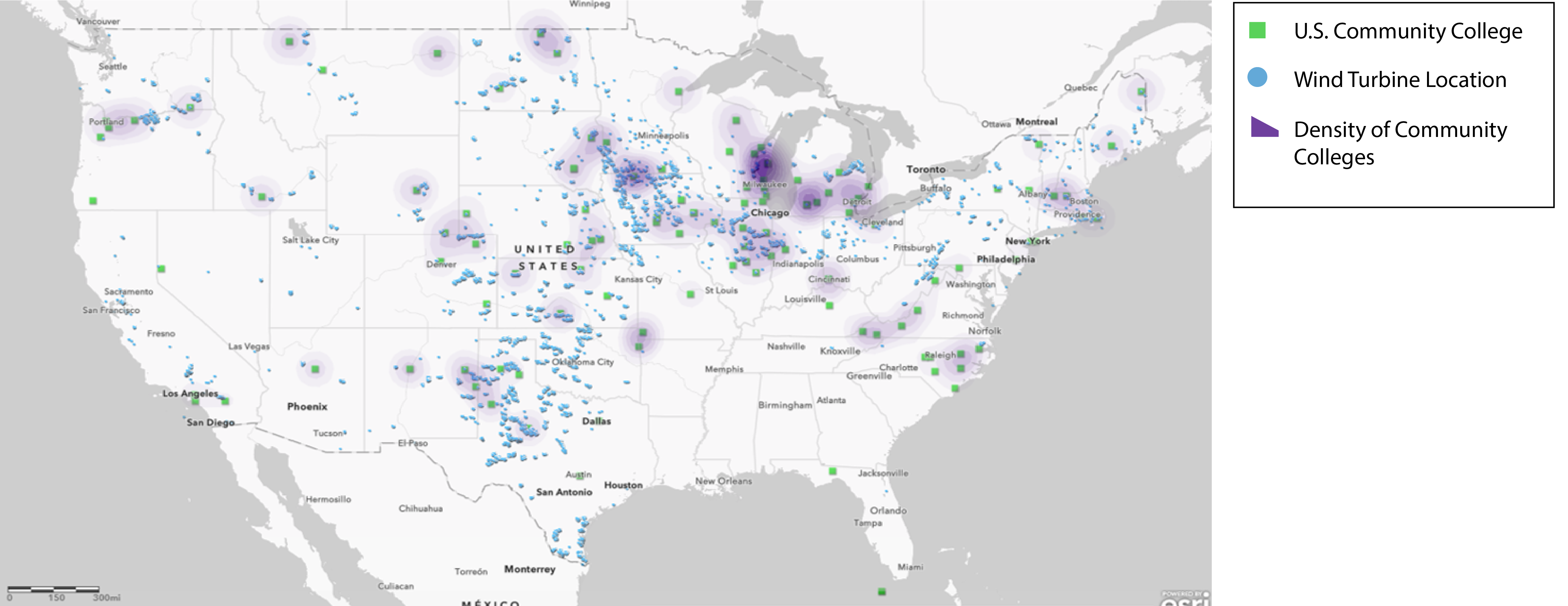

Windexchange Wind Energy Economic Guide

Indiana Property Tax Calculator Smartasset

Georgia Sales Tax Rates By City County 2022

Windexchange Wind Energy Economic Guide

Kansas Income Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Windexchange Wind Energy Economic Guide

Tax Breakdown Shawnee Kansas Economic Development Council

Tax Breakdown Shawnee Kansas Economic Development Council

Sales Tax On Cars And Vehicles In Nebraska

Kansas State 2022 Taxes Forbes Advisor

Arkansas Property Tax Calculator Smartasset

Georgia Sales Tax Rates By City County 2022

Indiana Property Tax Calculator Smartasset

Tax Breakdown Shawnee Kansas Economic Development Council

Should You Move To A State With No Income Tax Forbes Advisor